March 17, 2020

Nondeductible IRA contributions require careful tracking

February 25, 2020

Qualified Opportunity Funds: A new weapon in the estate planning arsenal

June 29, 2021

Part 2: Tax Considerations of Operating Your Business

January 15, 2026

Reporting Cryptocurrency on Your Tax Return

September 10, 2025

Tax Considerations for Executives Moving to the U.S.

November 10, 2025

Why Monitoring AGI Matters More Than Ever Under OBBBA

November 19, 2025

IRS Retirement Plan Contribution Limits for 2026

January 6, 2026

2025 Tax Prep Tips for Individuals

February 5, 2026

Vacation Home Ownership Options: Why Many Families Choose an LLC and Trust

March 3, 2020

IRS confirms large gifts now won’t hurt post-2025 estates

January 23, 2020

IRA charitable donations are an alternative to taxable required distributions

February 10, 2026

Trust Planning 101: A Practical Guide for High-Income Families

February 12, 2026

Trust Planning 101: Taxes, Funding, Trustees, and Pitfalls

February 4, 2020

Don’t worry! A broken trust can be fixed

August 13, 2019

Philanthropic and family benefits of charitable lead trusts

January 14, 2020

Flex plan: In an unpredictable estate planning environment, flexibility is key

July 11, 2019

Leave your mark with a dynasty trust

November 12, 2019

When it comes to asset protection, a hybrid DAPT offers the best of both worlds

June 25, 2019

Beware if your estate plan leaves specific assets to specific heirs

July 27, 2019

Thinking about retiring to another state? Do not forget about taxes

January 3, 2019

Don’t get taxed twice on nondeductible IRA contributions

June 18, 2019

Selling your home? Consider these tax implications.

February 6, 2019

It’s time to organize your tax records!

June 4, 2019

Make healthcare decisions while you’re healthy

December 7, 2017

Pre-Tax Reform Planning Opportunities

April 11, 2019

5 things to know about substantiating donations

June 20, 2016

The Search for Consistency: Form 8971 and the New Basis Reporting Requirements

September 25, 2018

Dynasty Trusts are more valuable than ever

August 27, 2015

Mortgage Interest Itemized Deduction- Per-residence or Per-taxpayer Approach?

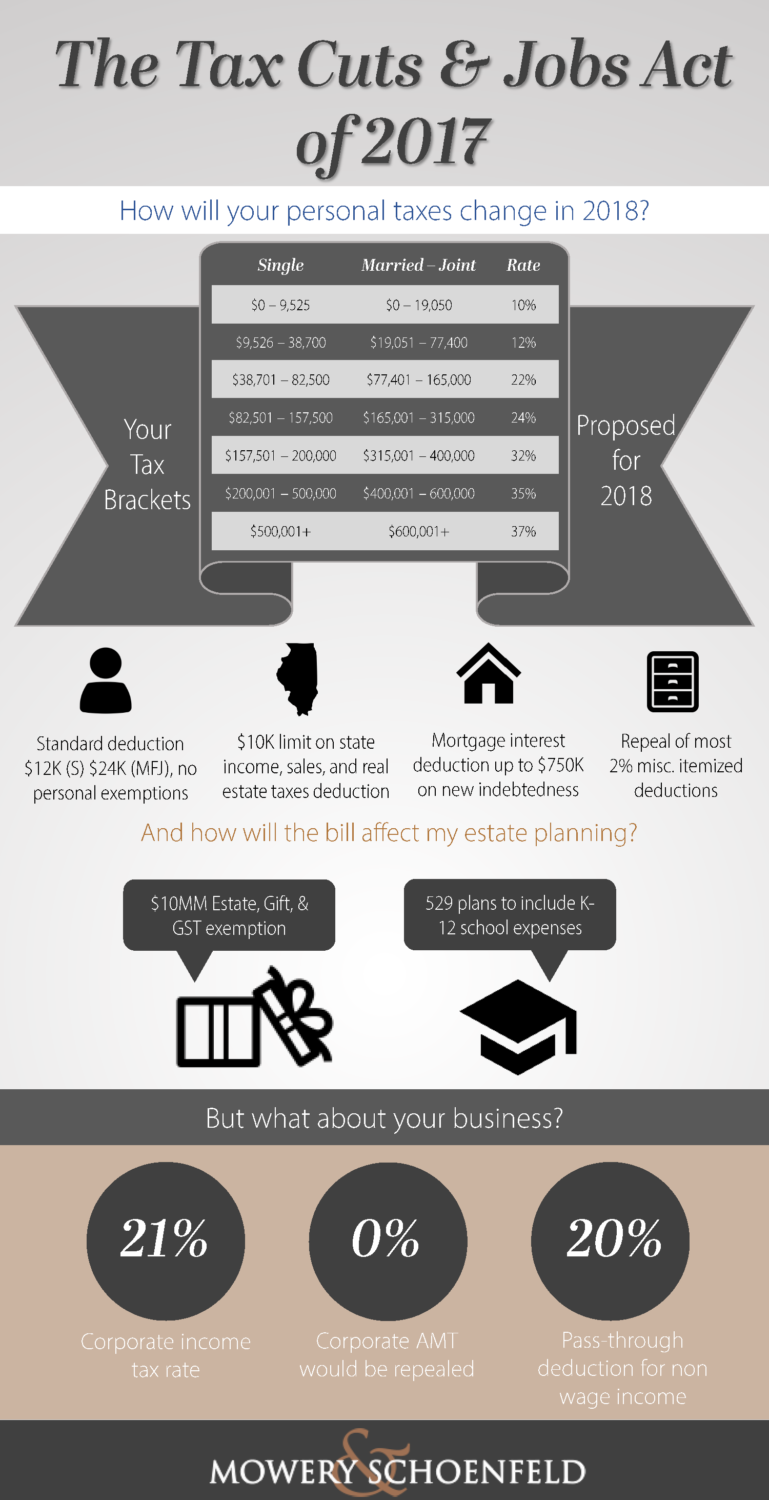

December 18, 2017

The Tax Cuts & Jobs Act

June 25, 2015

Red Flags for IRS Audits

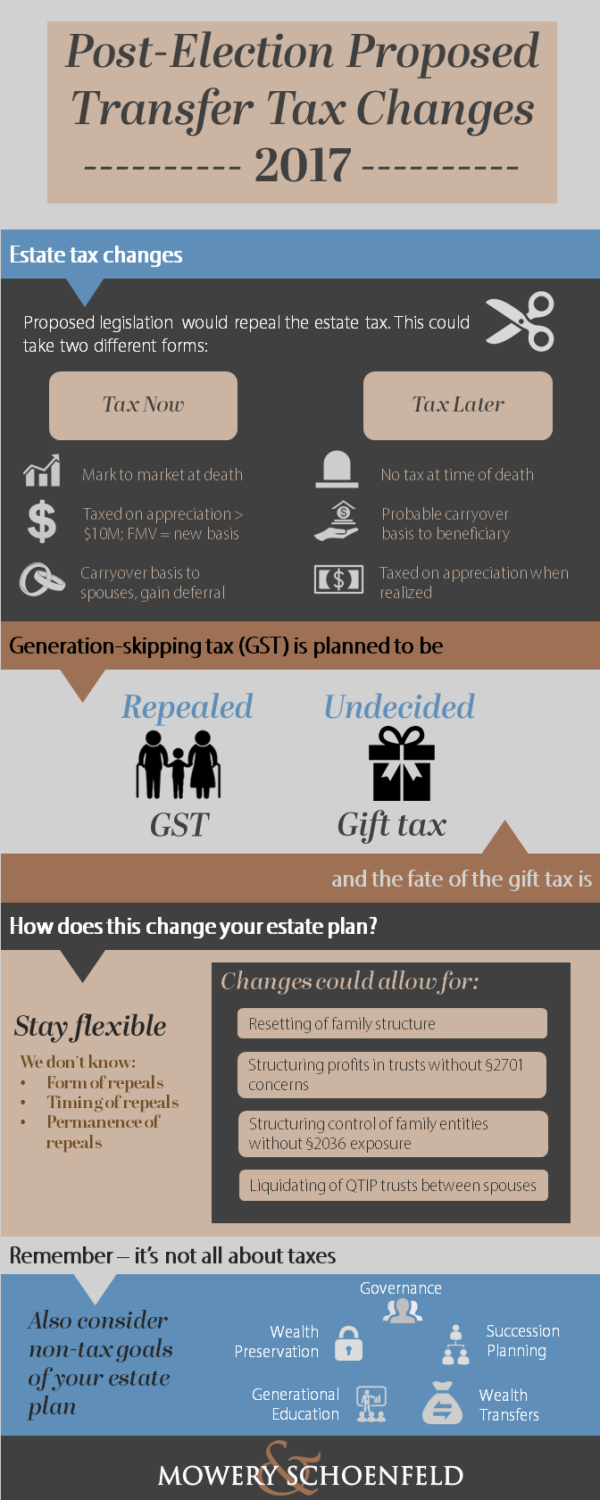

December 7, 2016

Post-Election Proposed Transfer Tax Changes for 2017

October 1, 2015

Accounting For Digital Assets In Your Estate Plan

April 23, 2014

Thinking of Changing Your Residence for Tax Purposes? There are Many Considerations.

October 11, 2015

Family Limited Partnerships- What You Should Know

October 19, 2015

Estate Tax Planning Focus Shifts to Income Taxes

October 21, 2015

Tax Basis Planning- Taking the Right Steps

October 22, 2015

Planning for Retirement Income

December 21, 2015

PATH Act of 2015 Permanently Extends IRA Charitable Rollover Provision!

November 4, 2015

Charitable Giving as Seen Through an Estate Planning Lens

March 25, 2025

FinCEN Narrows BOI Reporting Scope with New Ruling

June 15, 2021

Can your estate plan keep up with proposed legislation?

June 8, 2021

Legislation is coming. Are you ready?

November 2, 2023

EFTPS Access Now Requires Multifactor Authentication

November 7, 2023

Weighing Your Charitable Giving Options

December 21, 2023

Offset Nursing Home Costs With Possible Tax Breaks

December 27, 2023

Planning for Net Investment Income Taxes

January 24, 2024

Tips to Prepare for the 2023 Tax Season

November 20, 2025

Understanding IRS Audits: What to Expect

October 4, 2024

Reduction in Estate and Gift Tax Exemption: What You Need to Know After the 2025 Sunset

November 24, 2025

Schedule K-1 Process and Summary of Reporting Requirements

February 12, 2025

Tax Prep Checklist for Individuals

February 19, 2025

Setting Up EFTPS for Online Tax Payments

March 27, 2025

Taxpayer Scams Are on the Rise—What Can You Do to Stay Safe?

June 30, 2025

IRS Audit Triggers to Avoid on Your Tax Return

April 24, 2025

Lesser-Known Benefits of HSAs

June 10, 2025

Minimizing Tax on Your Rental Property

June 3, 2025

IRS Moving to Digital-Only Tax Refunds and Payments: What You Need to Know

July 10, 2025

What the One Big Beautiful Bill Act Means for Individuals

August 7, 2025

How the OBBBA Changes Charitable Deductions

September 4, 2025

OBBBA’s State and Local Tax (SALT) Changes, Explained

September 9, 2025

Qualified Small Business Stock Rules Under OBBBA

October 3, 2025