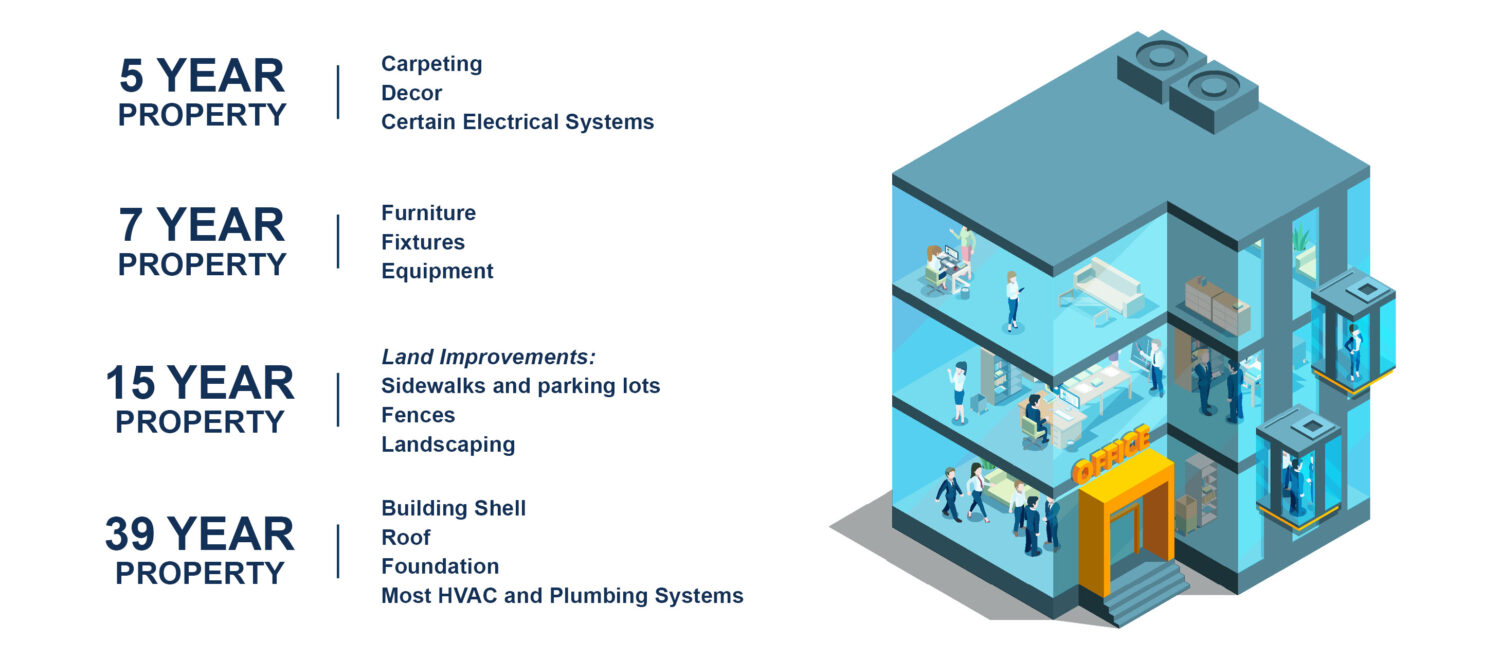

If you own commercial real estate, you are likely familiar with the traditional 39-year cost recovery period the IRS assigns to such property. But what if you could segregate some of the property into items that qualify for 15-, 7-, and even 5-year cost recovery periods? This would accelerate your depreciation deduction and increase your current year cash flow. Reclassifying property into shorter recovery periods also enables most reclassified property to qualify for bonus depreciation, adding to the acceleration of tax depreciation deductions. Taking advantage of the tax law requires careful planning and in-depth knowledge.

Our cost segregation team has a complete understanding of property depreciation rules and regulations, and will work with our engineering partners to perform a complete property analysis. In this analysis, we will determine which assets can be assigned shorter recovery periods, accelerating your cost recovery and freeing up your cash flow.