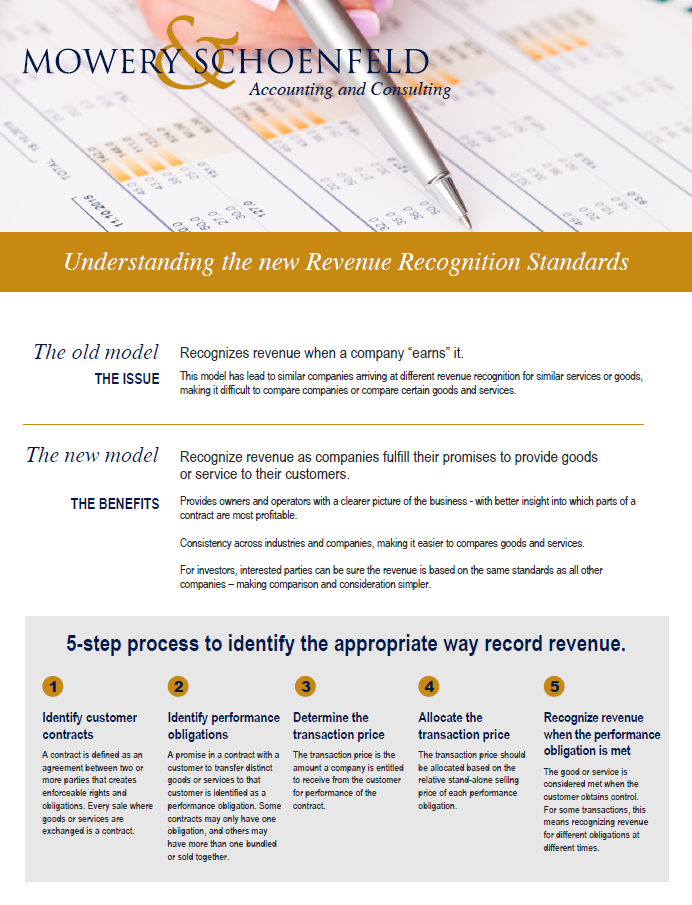

Recognizes revenue when a company “earns” it

The old model led to similar companies arriving at different revenue recognition for similar services or goods, making it difficult to compare companies or compare certain goods and services.

In addition, US GAAP had over 200 pronouncements about how to recognize revenue, leading to inconsistencies, even within companies and industries.