Welcome to Part 2 of our series evaluating the possible impact proposed legislation may have on your tax situation. Today we are going to explore the potential impact on estate and gift planning.

Proposals under review with Congress have the potential to upend planning for large estates. Is your estate prepared?

If you take one thing away from this article, it should be this:

For anyone with a net worth over $3.5 million, it is time to review your estate plan before any laws take affect.

Under the current Tax Cuts and Jobs Act (TCJA), the unified estate and gift tax exemption is $11.7 million per person. The top tax bracket for estates is 40%. Proposals under consideration would:

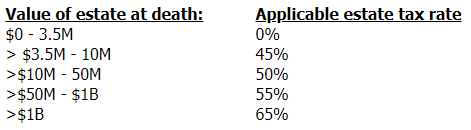

- reduce the exemption to $3.5 million per person and increase the top tax bracket to 65%

- tax capital gains and qualifying dividends at ordinary income rates applied to individuals with taxable income exceeding $1 million

A progressive estate tax bracket is also being proposed, as outlined below:

Possible changes to exclusions and new recognition of capital gains

- Reduce the lifetime gift exemption to $1 million per individual, $2 million per couple. Lifetime gifts would reduce the $3.5 million estate tax exemption.

- Apply a $1 million exclusion to property transferred at death, less any exclusion previously used toward gifts. Up to $100 thousand could be used during a person’s lifetime.

- Eliminate the basis step-up on appreciated assets, triggering capital gains. Unrealized gains would be treated as “sold” to the beneficiary upon death. Gains would be taxable to the extent they exceed the $1 million exclusion.

- Implement a 21-year-rule on all non-grantor trusts, regardless of when they were created, taxing unrealized gains every 21 years (“deemed realization”). Taxes on deemed realization of illiquid assets would be payable over 15 years and deductible to the estate for estate tax purposes.

- For gifts or bequests with unrealized gains directed to a spouse, a trust with a spouse as the sole beneficiary, or a charity, there would be an exemption. For transfer to spouses/trusts, unrealized gains would be taxed as ordinary income at the spouse’s death.

- One proposal reduces the maximum annual gift tax exclusion to $10 thousand per recipient and a total of $20 thousand per donor per year.

Changes in Estate Planning

You’ve spent years developing and executing (and paying for) a careful estate plan to protect your wealth and financial legacy. So, how much of it is about to change?

The answer, as is always the case with taxes, is it depends. Some of the traditional estate planning vessels will be grandfathered in under proposed changes, others will require immediate attention. Let us explore how various trusts and other tools would change.

Grantor Trusts: A grantor trust is a trust in which the grantor owns trust assets and is revocable during the grantor’s lifetime. Under proposed legislation, the grantor of a trust would be the “deemed owner” of trust assets. New rules would apply to all IRC Sec. 678 trusts, including Spousal Lifetime Access Trusts, Intentionally Defective Grantor Trusts, Irrevocable Life Insurance Trusts, Beneficiary Deemed Owner Trusts and Beneficiary Defective Inheritors Trusts.

This change would require assets to be included in the grantor’s estate at death, subjecting them to estate tax. Any distributions made to non-spouse beneficiaries during the grantor’s life would be treated as gifts, subject to gift tax. If the grantor ceases to be the “deemed owner” of the trust, assets attributed to the grantor may be subject to gift tax upon transfer.

Grantor trusts created prior to the date of enactment would be grandfathered in and subject to the current law.

Grantor Retained Annuity Trusts (GRATs): A GRAT is a common estate planning tool used to transfer large gifts within a family over time. Typically, the grantor makes a small taxable gift upon creating the trust, and when the trust expires, the remaining trust assets are distributed to the beneficiaries tax-free.

Proposals under consideration would require a minimum duration of 10 years and a minimum taxable “remainder interest” would apply, calculated as the greater of 25% of the trust’s value or $500,000, determined at the time of creation.

Generation-Skipping and “Dynasty” Trusts: A generation-skipping trust is established to transfer wealth from generation to generation.

Proposals under consideration would cap the duration of these trusts at 50 years. After 50 years, distributions from the trust to a skip person would be subject to the generation-skipping transfer (GST) tax.

The new limit may apply to both newly created and existing trusts.

Valuation discounts: Traditionally, valuation discounts have been applied to minority interests in businesses that were gifted or transferred under the assumption that part of the value of an interest was attributable to its marketability, and interests transferred in the absence of marketability should reflect a discounted value. This has been a valuable tool in minimizing the values of transfers subject to gift and estate tax.

New proposals would disallow valuation discounts on the transfer of non-business assets held in business entities and partial interests in entities majority-owned or controlled by family members.

Be Proactive

To protect your legacy and avoid triggering hefty tax bills for you and your family, you should act with as much prudence and notice as possible. The important thing to remember is there are options, and there is action you can take now to minimize the effects of any legislative changes. Here are a few things to consider:

- Review your estate plan for instruments subject to change under the proposals. Consider creating grantor trusts and making gifts in the current year to take advantage of grandfathered policies and exemptions. Utilize life insurance policies to avoid income tax on future proceeds. Our Estate and Gift Tax team can help you strategize and prepare for any upcoming changes.

- Plan your trust income and deductions. Accelerate income into 2021, including realizing gains in IDGTs. Defer deductions and capital losses to minimize the impact of increased tax rates. Reach out to your M&S Tax Advisor to review your current and expected tax situations.

While some of these provisions are more likely than others, there is one thing we can be sure of – change is coming. We fully expect Congress to move on tax legislation, and we will be following the situation closely. As always, it is our priority to keep you informed. In the meantime we strongly urge you to reach out to our team to ensure adequate time for planning opportunities.