Many retirement plan sponsors consider converting to new providers starting with the new plan year. For calendar year plans, that means January 1. If this is the case for your company, now is a good time to evaluate your plan and ensure your provider is truly providing.

Basic questions

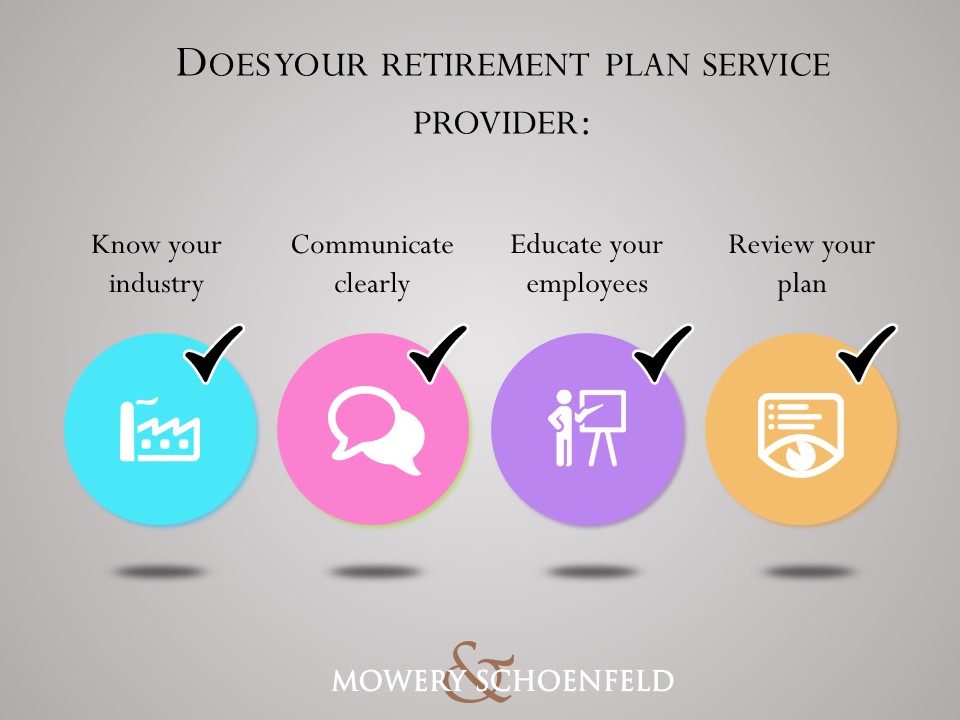

Your provider should have demonstrable experience in your industry. Check to see whether your current provider (or a prospective one) has clients with plans similar to yours. Ask for references.

Service and administration should be easy, and communications clear. Reports from your provider should be timely and accurate. You shouldn't have problems contacting your service provider, and they should give quick and accurate answers to routine questions.

Look for a provider that offers educational seminars for employees to help them understand the importance of maximizing their savings. Make sure the provider has a website that your employees can access, and that participant statements and reports are user-friendly.

The provider should give ongoing plan reviews, including open discussions of participation levels, deferral percentages, loans, nondiscrimination testing, and enrollment and communication strategies.

Cost considerations

Remember, cost is not always the prime driver in the decision. Certain providers market their services directly to plan sponsors with the idea that the cost of an advisor is unnecessary. Generally, this type of arrangement works only if the plan sponsor has an employee dedicated to certain 401(k) plan functions or the plan accepts less service.

The 401(k) fees paid by a company typically include a one-time fee to establish the plan and an ongoing annual, quarterly, or monthly fee to manage it. The costs cover record keeping, support from an account manager, government-required testing and tax forms, and product and service improvements. Administrative expenses vary dramatically based on the provider and the total plan assets.

It is also important to minimize the fees employees pay, allowing them to invest more of their money. Add up the average fund expenses plus the management fees, custodial fees, or any other fees charged to your employees to get to the full amount they are paying for the services.

Competitive necessity

Comprehensive, well-administered benefits are a competitive necessity in today's business environment. Be sure to evaluate and fully understand the services you're receiving and their associated costs.