As promised, we have been following developments in proposed tax changes and we are committed to keeping you updated.

The House Ways and Means Committee has released a new bill containing tax hikes for individuals and businesses. We have included key highlights of the proposal below, for you, your business, and your estate plan.

Please note, these changes are not yet law. We will continue to monitor proposals as they make their way through the legislative process.

Key highlights for individuals

- Increase in top marginal tax rate to 39.6%

Currently, the top marginal rate is 37% for individuals. It is applied to taxable income over $523K/$628K for single/MFJ filers. The House plan would apply the increased rate to taxable income over $400K/$450K respectively effective after 12/31/21. The increased rate would also apply to estates and trusts with taxable income over $12.5K - Additional surtax

A new 3% tax would be imposed on modified adjusted gross income in excess of $5M effective after 12/31/21. Combined with the proposed top tax rate and the existing 3.8% Net Investment Income Tax, this would bring the top marginal rate to 46.4% for ordinary income and 31.8% for long term capital gains and qualified dividends. - Expansion of the NIIT

The legislation would expand the Net Investment Income Tax (NIIT), effective after 12/31/21, to apply to virtually all income not subject to employment or self-employment taxes for taxable income over $400K/$500K for single/MFJ filers. - Increased capital gains tax rates

The plan increases tax on capital gains and qualified dividends from 20% to 25% for individuals with taxable income over $400K. Combined with the Net Investment Income Tax (NIIT), capital gains would be taxed at 28.8%. This change would be effective for sales after 9/12/2021, with exceptions for binding contracts.

The plan proposes substantial changes to retirement accounts. Please stay tuned for a comprehensive summary of the proposed legislation as it relates to your retirement planning.

Previously discussed changes to the $10K State and Local Tax (SALT) deduction cap were not included in this proposed bill.

Key highlights for businesses

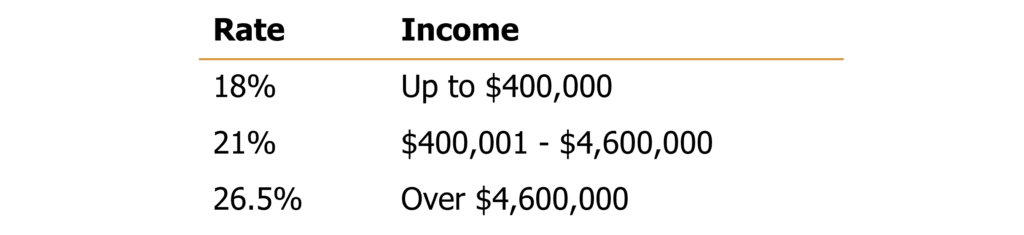

- Increase corporate tax rate to 26.5%

This is the top end of a proposed graduated rate structure:

Personal service corporations are also not eligible for the benefit of graduated rates.

- Cut the Small Business Deduction

Business owners with income of more than $400K/$500K for single/MFJ, would no longer be eligible to receive the 20% Qualified Business Income (QBI) deduction - Research and Experimental (R&E) expenditures

The plan delays amortization of R&E expenditures starting after 2022 to 2025 (or later). - Holding period for carried interest

With the increased capital gains tax rate proposed in the plan, the carried interest spread would be closing. The legislation proposes a five-year holding period to qualify for carried interest. Real estate businesses would retain a three-year holding period. - Limitations on §1202 Gains (QSBS)

Sales of Qualified Small Business Stock are complex and highly-specific transactions. If you think these limitations may apply to you, reach out to your M&S Tax Advisor today. We will work with you to determine how the proposed changes would impact your financial situation.

Previously discussed §1031 treatment changes were not included as part of this proposal.

Key highlights for estates

- Decrease lifetime exemption

The plan would decrease the lifetime exemption to the 2010 level of $5M per individual (indexed for inflation) effective January 1, 2022. - Disallow valuation discounts

The plan would disallow the use of valuation discounts for nonbusiness assets, effective immediately upon passing. Nonbusiness assets are passive assets not used in the active conduct of a trade or business (i.e. family limited partnerships). - Limitations in the use of grantor trusts

The proposed plan would treat a grantor trust created on or after the date of enactment as includible in the grantor's estate. Although existing grantor trusts may still avoid estate tax inclusion, any contributions to an existing trust after the date of enactment would be includible in the grantor's estate as well. The proposed plan would treat the sale of assets to a grantor trust as taxable for income tax purposes. These changes would be effective immediately upon passing.

Previously discussed elimination of the step-up in basis at death were not included as part of this proposal.

Remember, this is only a summary of changes which may pass. We anticipate many changes before the bill is finalized and voted upon. As always, we will continue to provide the most up-to-date information. If you have any questions on concerns, please do not hesitate to reach out to your M&S Tax Advisor as soon as possible.