Cost segregation is a strategic tax planning tool that allows businesses to accelerate the depreciation of certain assets, resulting in significant tax savings. By classifying assets into shorter recovery periods, businesses can deduct larger portions of their investments in real estate and other fixed assets upfront, reducing their taxable income and increasing cash flow.

Depreciation rules and overview

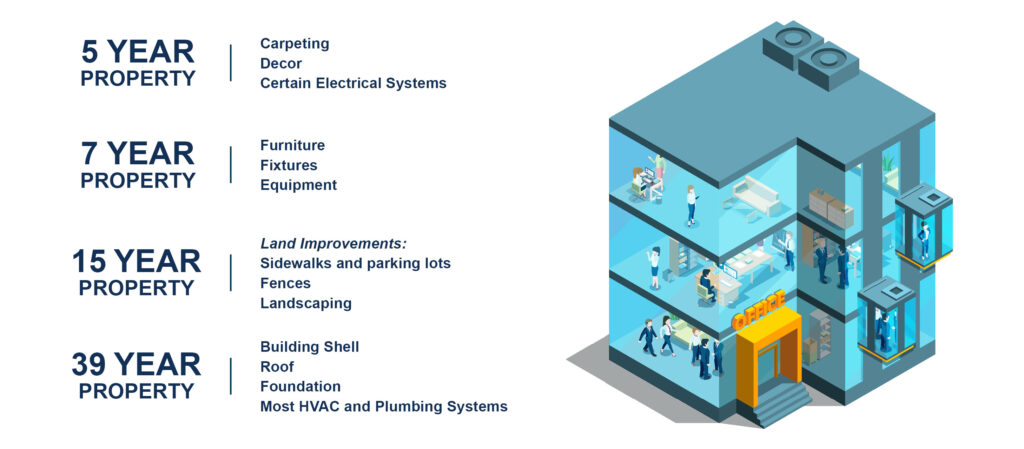

Depreciation is the method used to recover the cost of a tangible asset over its useful life. The IRS provides guidelines on how assets should be depreciated for tax purposes. Traditionally, buildings were depreciated over 39 years for commercial properties. However, cost segregation allows taxpayers to identify and separate specific components of a building or property that can be depreciated over shorter time frames.

Cost segregation study process

To conduct a cost segregation study, taxpayers typically engage the services of a qualified professional, such as a certified public accountant (CPA). The process involves a detailed analysis of the property's construction plans, blueprints, and other relevant documentation. Following an onsite visit and property inspection, the expert will then identify and reclassify assets into different categories based on their respective recovery periods.

The study considers various components, including but not limited to electrical systems, plumbing, HVAC (heating, ventilation, and air conditioning), interior finishes, and specialized equipment. By segregating assets into shorter recovery periods—such as 5, 7, or 15 years, instead of the standard 39 years—taxpayers can accelerate their depreciation deductions and realize immediate tax benefits.

Benefits of cost segregation

Increased Cash Flow: Cost segregation allows businesses to reduce their taxable income in the early years of property ownership. By accelerating depreciation deductions, taxpayers can free up cash flow that can be reinvested in the business or used for other purposes.

Better Understanding of Profitability: By recognizing depreciation deductions sooner, cost segregation provides a clearer picture of the property's profitability and help investors make informed decisions.

Enhanced Tax Planning and Flexibility: Cost segregation offers taxpayers greater flexibility in managing their tax liability. It allows for the deferral of tax payments, increased deductions, and potential tax savings that can be reinvested in other projects or initiatives.

We’re here to help

Cost segregation is a valuable tax planning strategy that allows taxpayers to accelerate depreciation deductions by classifying assets into shorter recovery periods. It offers increased cash flow, improved ROI, and flexibility in managing tax liabilities.

Over the years, cost segregation has gained acceptance and evolved through IRS guidance and tax court cases. By leveraging the opportunities it presents, taxpayers can maximize their tax benefits and optimize their overall financial position.

If you’d like to find out more about cost segregation, contact your M&S tax adviser today. You can also learn more about our process here.