No matter their income level, most Americans have felt the effects inflation is having on the cost of living. Despite predictions to the contrary, the annual inflation rate in August was 8.3% — down only slightly from the month before. And while the price of gasoline has dropped sharply from its record high in June, other costs—including rent, groceries and electricity—continue to rise and take up a bigger portion of Americans’ paychecks.

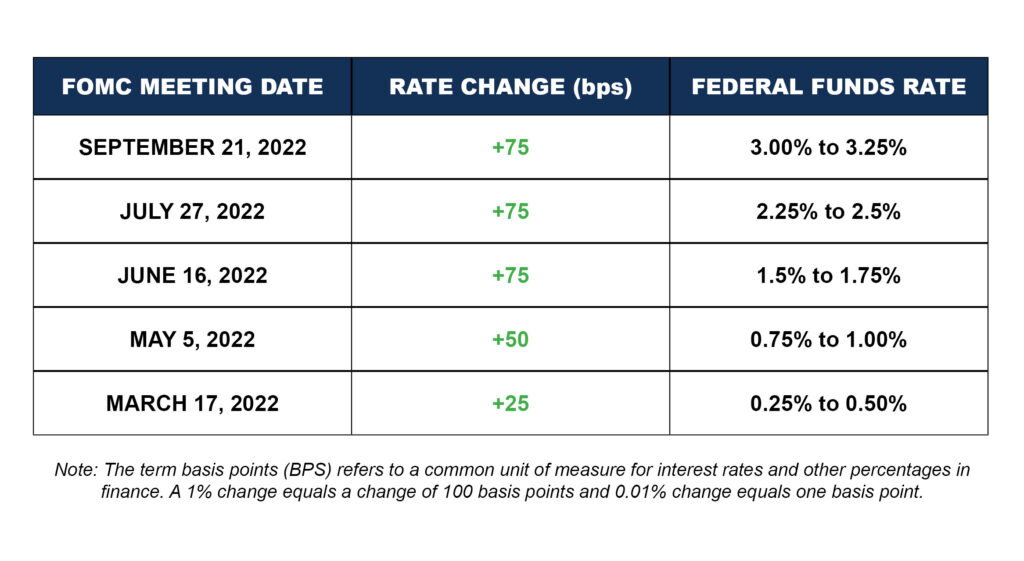

On September 21, the Federal Reserve raised rates another 0.75% as the next step in their attempt to quell the adverse effects of inflation on Americans. Although this can help the economy recover in the long term, Americans are likely to feel the effects of this hike in both their monthly budgets and big purchases.

Understanding the increase

As the central bank for the United States, the Federal Reserve is tasked with setting monetary policy to promote maximum employment, stable prices, and moderate long-term interest rates to support conditions for long-term economic growth. Banks and similar institutions then target this range when they lend overnight money to one another. They use these hyper-short-term loans to collectively maintain their required cash reserves, or to otherwise raise immediate operational cash.

When the Fed increases the target funds rate, it’s hoping to reduce the flow of excess cash or stimulus in the economy, which in turn can help temper inflation. Alternatively, when the Fed lowers the target funds rate (as it did during the pandemic and the Great Recession), it’s hoping to keep stimulating cash flowing through the economy without letting inflation get out of hand. As recently as the first quarter of 2022, the Fed was holding the federal funds rate at around zero while also still buying billions of dollars of bonds every month to stimulate the economy. Now, the Federal Reserve is hoping to make these raises slowly and incrementally so as to avoid a recession.

According to NPR, Federal policymakers think the rates will climb to about 4.4% by the end of this year.

Borrowing and saving

The frequency and size of the Fed increases is making it harder for Americans to make decisions about borrowing and saving. Previously, a rise in rates would bring big savings for high-yield savings accounts, but the same is not true now. Simply put, it’s because banks have no incentive to raise the interest they pay on deposits because they don’t need the funds.

There are still some savings: just six months ago, holding $1000 in a Marcus account meant you would net 0.5% in interest, but now the same account is offering 1.9% in annual percentage yield. This means those who are saving in high-yield interest accounts are gaining an extra $14 in interest over a year, up from the $5 in interest gained at the previous rate.

Retirement

In general, inflation causes problems for retirees since they generally live on a fixed income made up of Social Security, pensions, and withdrawals from their retirement portfolios. With inflation—specifically sustained inflation over a number of years—purchasing power can be drastically reduced, especially without cost-of-living adjustments in pension payments or strong investment markets to help buoy their retirement accounts.

Although Social Security does increase with inflation, the price indexes have historically led to cost of living adjustments which are less than prevailing inflation rates call for. Your 401(k) is impacted whenever the government attempts to act against inflation. When the Federal Reserve raises rates, interest rates rise, bond prices fall, and companies find it more expensive to raise debt.

When rates rise, people become concerned about things rising too sharply, which can slow down growth too much and tip the American economy into a recession. However, as is always true, it’s important to keep a long-term mindset and avoid making any hasty decisions. Diversified income streams and inflation-correlated investments might be beneficial, but you should consult with your wealth management team before creating drastic changes to your portfolio.

Credit card bills

Unfortunately, free-floating credit card debt is more likely to creep quickly upward in tandem with the Fed’s rates. According to the Federal Reserve Bank of New York, Americans’ total Q2 credit card balance was $887 billion, a $46 billion jump from $841 billion in the first quarter of 2022.

Meanwhile, because of the rate increases, the average annual percentage rate on a credit card increased from around 16.17% in early March to more than 18% in September, making having debt more likely and more expensive than in previous years.

Home buying

This time last year, homeowners were getting mortgage rates as low as 2.86%, but recently, mortgage rates have passed 6%, pushing already pricey homes further out of reach for many potential buyers. With rates that continue to rise and an average home price of around $400,000, housing affordability remains at its lowest level since 1989. Someone putting a 20% down payment on such a home with a 30-year mortgage and a 6% rate will now pay around $2,400 a month. If they made the same purchase six months ago, their monthly payments would be nearly $250 less.

Some buyers are pursuing Adjusted Rate Mortgages, or ARMs, as a way to split the difference. Currently, the average rate on an ARM is over a percent lower than a 30-year-fixed loan, which has led to 9% of buyers choosing this loan type in last month. Although these loans are riskier, they can help some buyers budget their monthly home payments—although they can’t guarantee the same lower rates in the future.

Car buying

In addition to home buying’s rising rates, Americans are also paying more than ever before to finance new car loans. Although individual dealerships and lenders can charge different amounts for a new loan, the average APR on a five-year loan has increased over the past six months from 3.98% to 5.07%. As the average price of a new car rises closer to $50,000, borrowers every month will be paying about $25 more.

We're here to help

The rising interest rates will continue to affect loans, credit cards, and retirement spending. Prudent financial steps become all the more important as the job market and your purchasing power both feel the effects of the rising rates. If you have any questions or concerns about what the Fed’s rate hike means to you, please contact your trusted advisor at M&S today.