Year-end tax planning for businesses often focuses on acquiring equipment, machinery, vehicles, or other qualifying assets to take advantage of enhanced depreciation tax breaks. Unfortunately, two "classic" depreciation breaks expired on December 31, 2014.

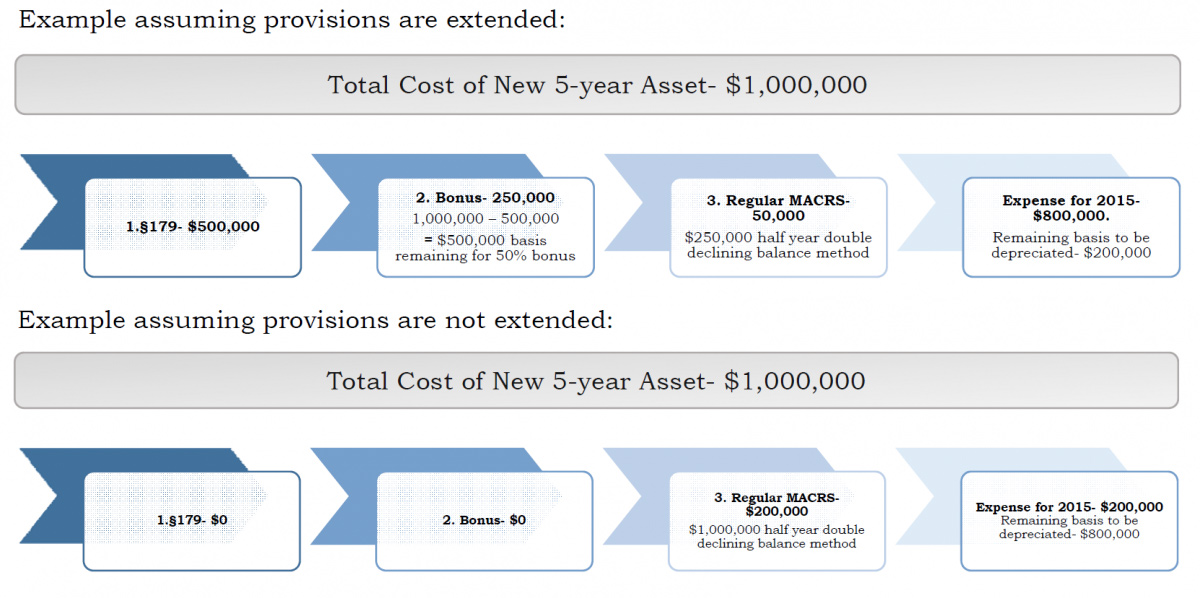

- Enhanced §179 expensing election- Before 2015, §179 permitted companies to immediately deduct, rather than depreciate, up to $500,000 in qualified new or used assets. The deduction was phased out, on a dollar-for-dollar basis, to the extent qualified asset purchases for the year exceeded $2 million. Because Congress hasn't extended the enhanced election beyond 2014, these limits have dropped to only $25,000 and $200,000, respectively.

- 50% bonus depreciation- This provision allowed businesses to claim an additional first year depreciation deduction equal to 50% of qualified asset costs. Bonus depreciation generally was available for new (not used) tangible assets with a recovery period of 20 years or less, as well as for off-the-shelf software. Currently it's unavailable for 2015 (with limited exceptions).

Lawmakers may also restore these breaks retroactively to the beginning of 2015. This does not seem to be a high priority for them as the 2014 provisions were not extended until the very end of the 2014 year. This situations can make investment discussions and the planning difficult as we can't be completely certain that the depreciation breaks will be extended for 2015. We have been taking the approach with clients that the benefits will be extended but also advising them of the continuing uncertainty.

For an example of the impact these provisions can have, assume you purchase and place into service an asset with a cost of $1,000,000. If the provisions are extended, this would result in up to $800,000 of current year expenses; under the current law, however, this would only result in a $200,000 maximum deduction.