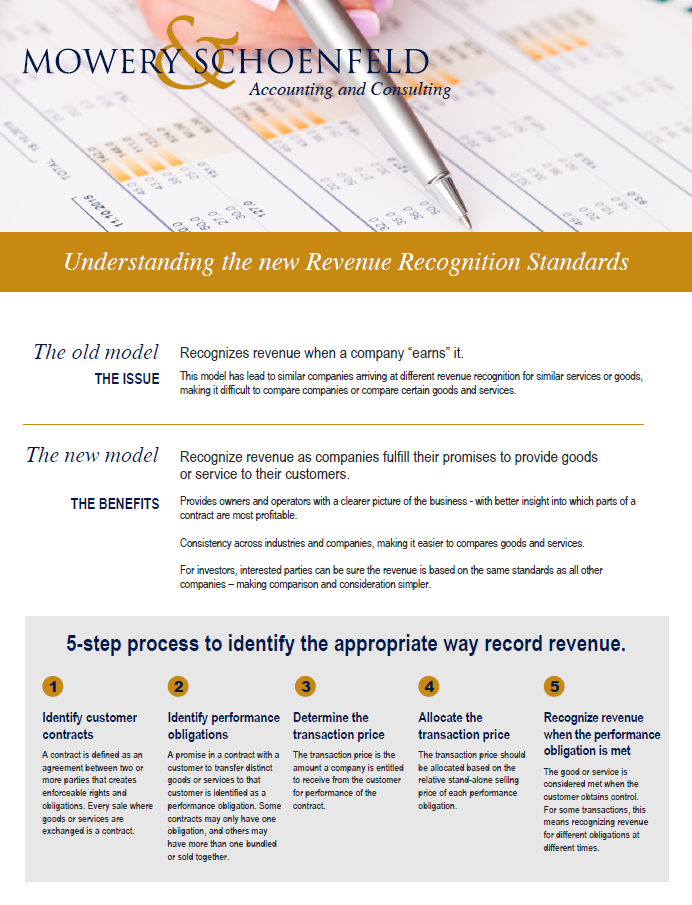

ASC 606 streamlines revenue recognition by replacing a patchwork of industry-specific rules with a single, five-step framework. Under this standard, revenue is recognized as your business fulfills its promises to customers — rather than when it is “earned” — offering greater transparency and consistency. This involves clearly defining contracts and performance obligations to ensure your revenue reporting is accurate and compliant. Both public and private entities reporting under U.S. GAAP (generally accepted accounting principles) are required to adopt ASC 606, while international companies follow similar guidelines under IFRS (international financial reporting standards).

Navigating these changes can be complex, which is why having an experienced advisor is essential. The team at Mowery & Schoenfeld is here to help you stay compliant, manage tax implications, and support a smooth transition to the new standard.