Schedule K-1 is a tax form required to be filed by pass-through entities (partnerships and S corporations) to report each investor's share of income, deductions, credits, and other tax-relevant items. Since these entities generally don't pay income taxes at the federal or state level, they "pass through" their tax obligations to partners or shareholders, who then report the information on their tax returns. Below is a summary of the tax deadlines and the importance of providing Schedule K-1s to investors in a timely manner.

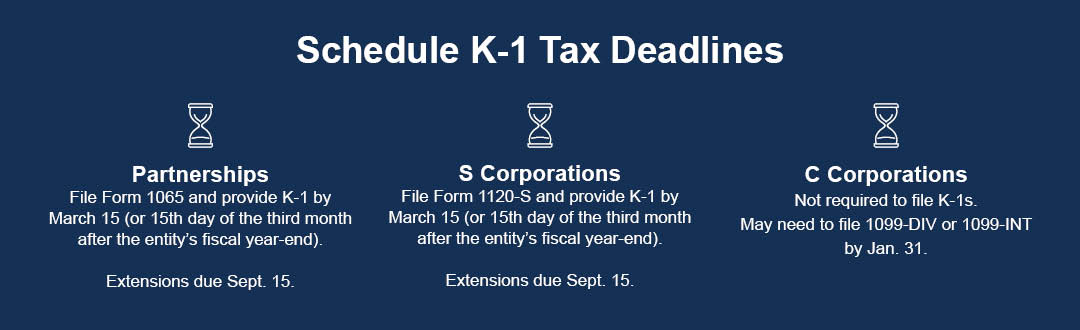

Schedule K-1 tax deadlines

Partnerships and S corporations: Partnerships must file Form 1065 and provide Schedule K-1 to partners by the March 15 deadline (or the 15th day of the third month after the entity's fiscal year-end). The due date for an S corporation mirrors the partnership filing deadlines, except S corporations file Form 1120-S. Both entity types are allowed an extension of time to file their tax returns and Schedule K-1s to Sept. 15 (or six months after the entity's original filing deadline).

C corporations: C corporations are not required to file Schedule K-1 and, therefore, do not have a yearly tax reporting obligation to investors. However, some tax reporting obligations might be required if the corporation pays dividends to its shareholders or has debt agreements directly with shareholders. In these circumstances, a 1099-DIV to report dividends or 1099-INT to report interest might be required. These forms are generally required to be sent to recipients by Jan. 31.

Importance of providing K-1s and estimated K-1s to investors

Taxpayers who are partners or shareholders in pass-through entities must report the information from their K-1 on their tax returns, which can be due by March 15 for other pass-through entities or April 15 for individuals, trusts, and C corporations. However, if a K-1 is delayed or unavailable by the filing deadline, investors must request an extension. Estimated K-1s provide a reasonable approximation of income, deductions, and credits, helping investors file accurate extensions to help avoid penalties for underpayment of taxes.

Schedule K-1 deadlines align with entity-level filing deadlines, but it's common for final K-1s to be delayed past the March 15 filing deadline due to the complexity of pass-through entity taxation and delays in finalizing the company's yearly financial statements. This is where estimated K-1s become crucial, as investors need to estimate their federal tax liabilities from underlying investments. Without estimated K-1s, investors could potentially be subject to late-payment penalties and interest with the Internal Revenue Service if they cannot properly estimate their projected tax liabilities.

In addition to federal tax implications, K-1s often affect state tax filings, depending on where the company is doing business. Certain states require estimated payments or additional documentation for pass-through entity income. By offering estimated K-1s, entities can help investors meet both federal and state tax payment obligations timely.

How Mowery & Schoenfeld can help

Your Mowery & Schoenfeld tax advisor will assist you in determining whether K-1s can be delivered before the March 15 filing deadline, or if estimated K-1s are needed for extension purposes. We recommend contacting your tax advisor immediately if you have any concerns with the timing of your company's K-1s to investors.